Remote Working

Effectively Addressing Requests to Work Remotely

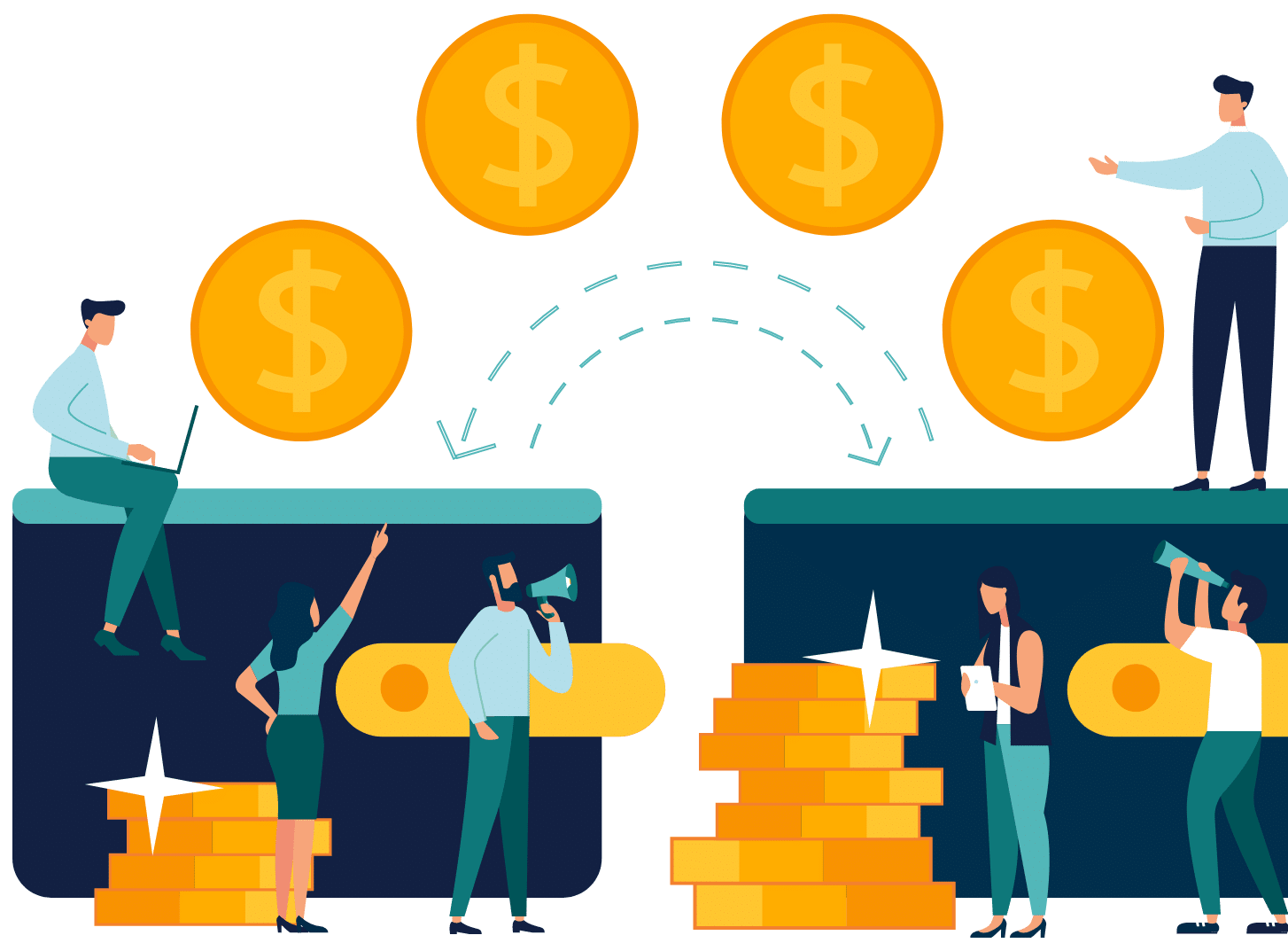

A successful remote work program effectively communicates a company’s policy. When these requests cross a border, a tax jurisdiction, or a corporate entity it is imperative that a company clearly outlines eligibility to enable compliance and set proper expectations.

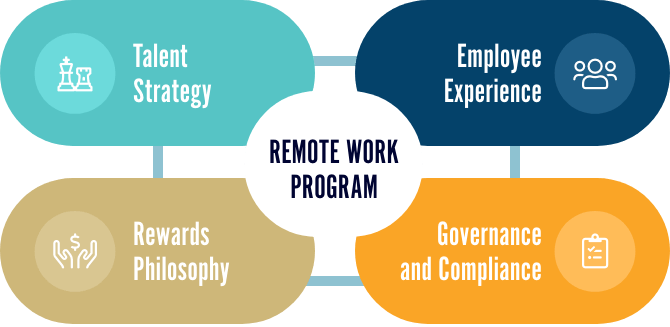

Remote work programs are further enhanced when they are tied to the company’s overall talent, compensation, and employee experience strategies. Once established, it is critical to clearly communicate the policy so that the entire organization can efficiently participate in the program.

Work Anywhere, Succeed Everywhere

AIRINC brings together the right information to help build an optimal remote work program for your company. The result is a well-developed program, aligned to your goals, with clear support guidelines, that everyone in your company knows how to participate in.